16% APR* on any credit card. Easily progress with your card debt and maximize your net worth.

The smartest way to pay off cards

Set and track debt-free goals

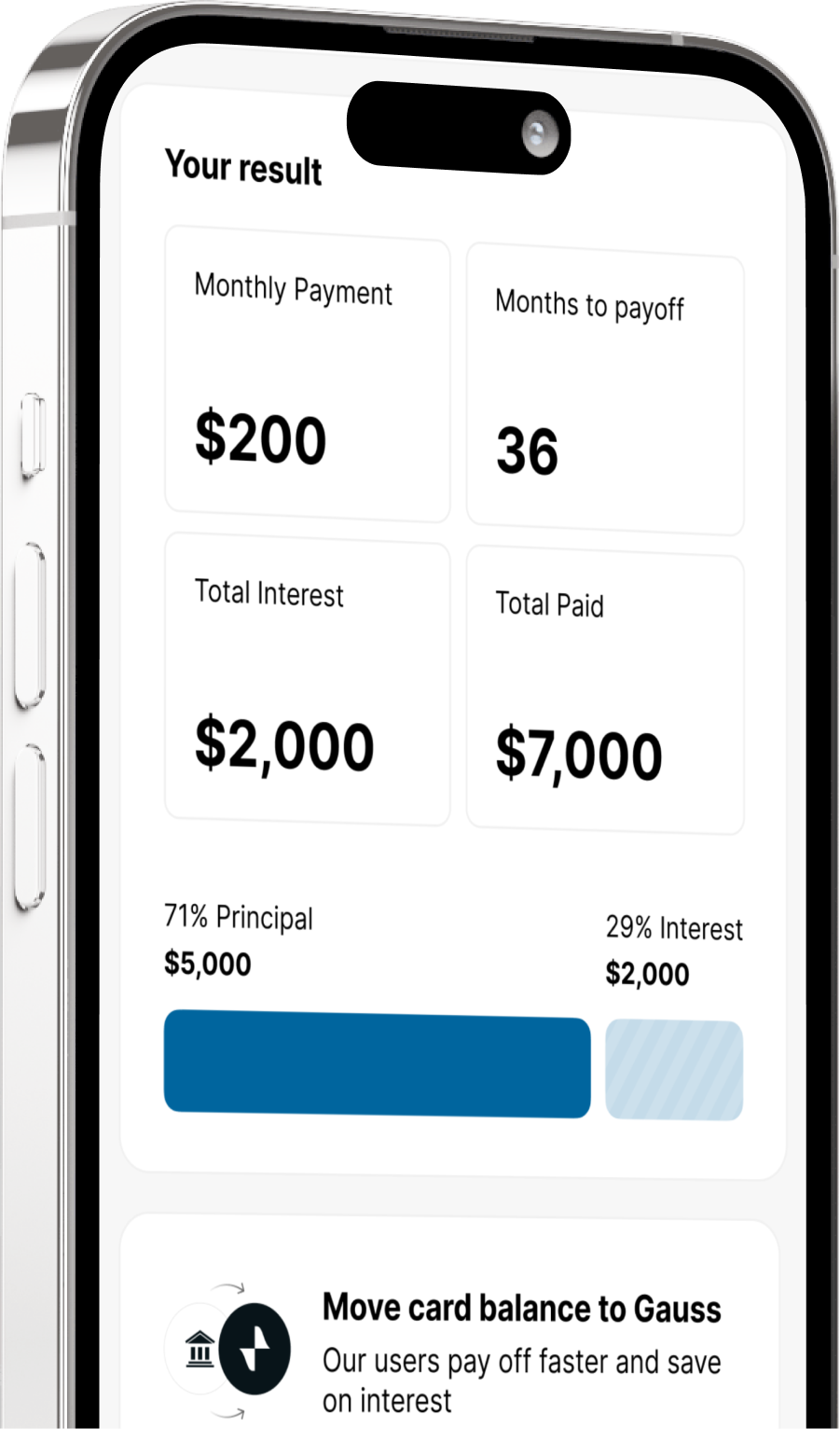

Build payoff plans for each of your cards in just a few taps. See debt-free dates, payments due, interest rates, fees and more. Graph your monthly progress and debt-related goals.

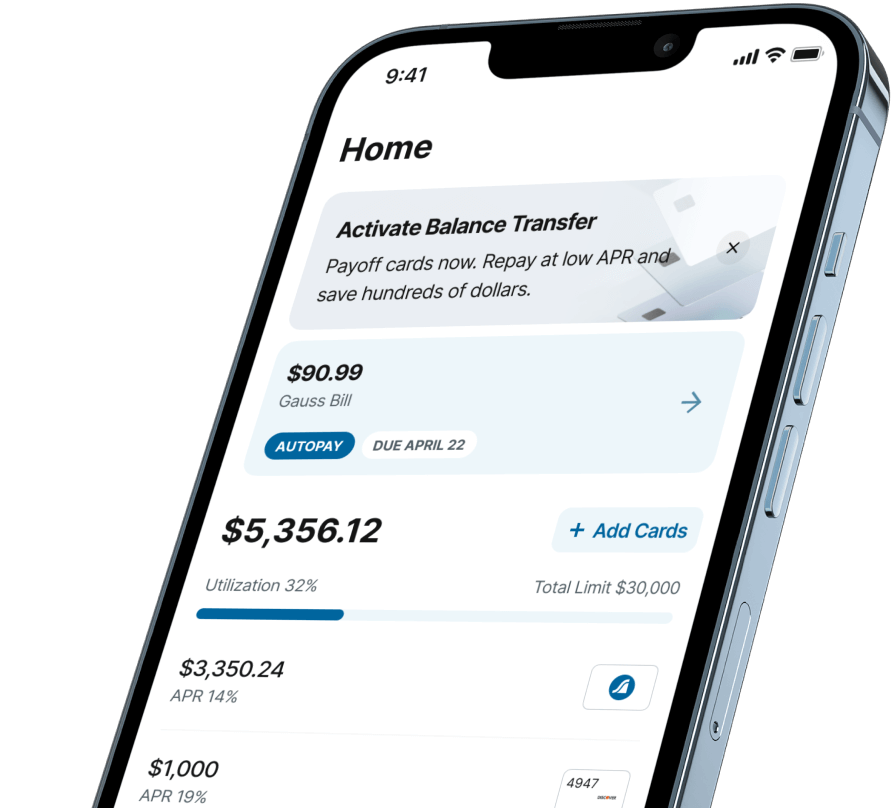

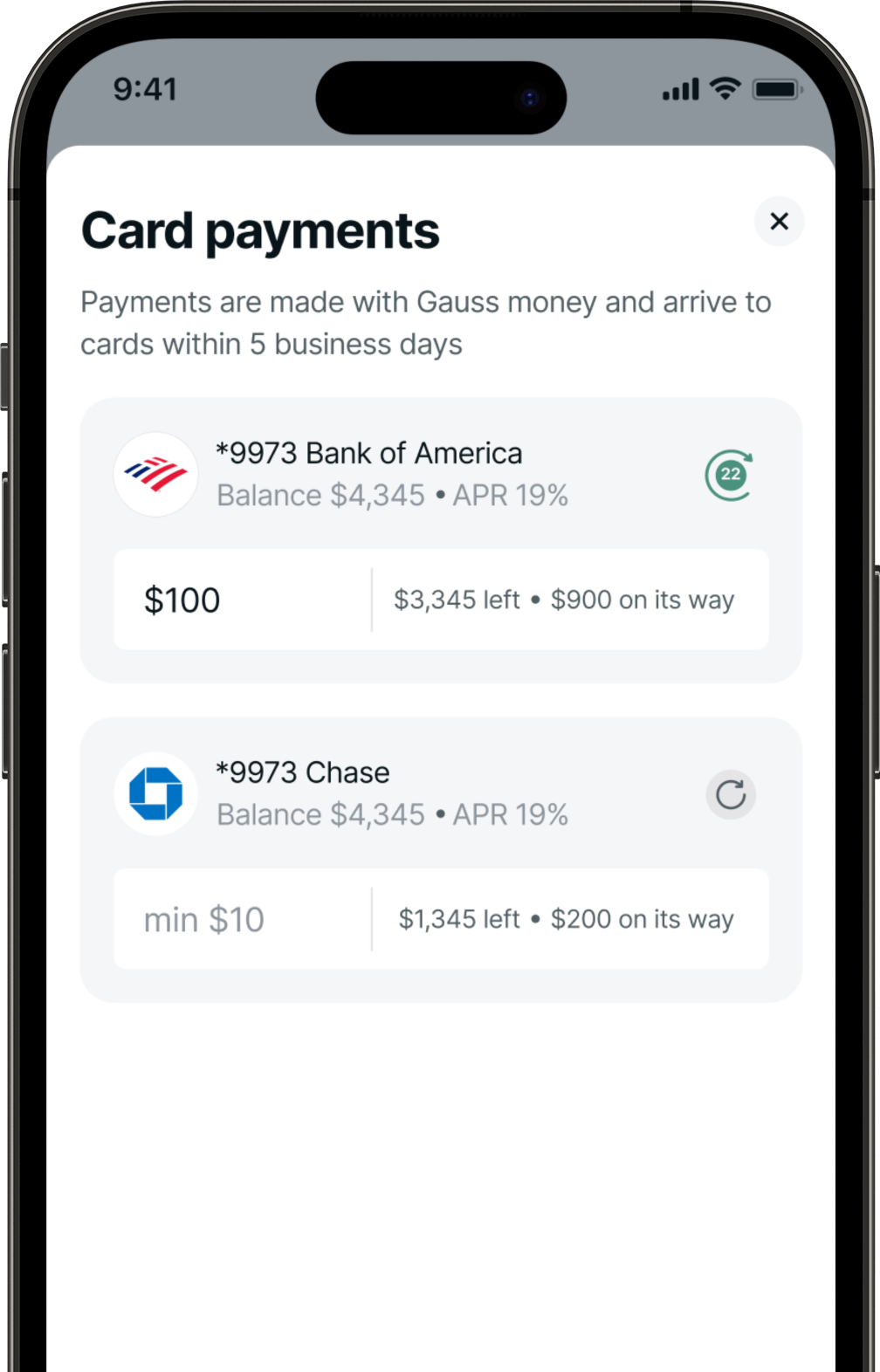

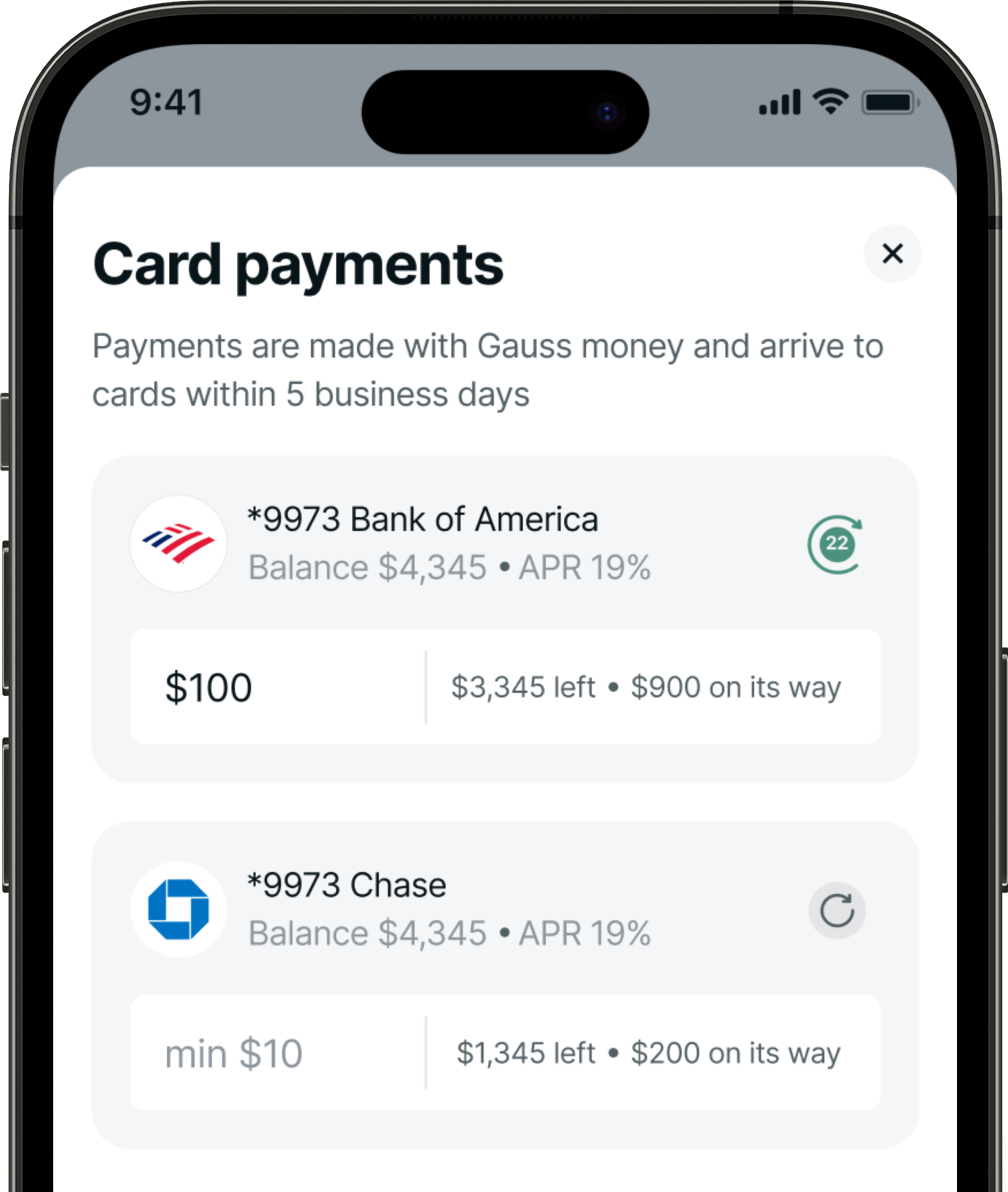

Pay off cards easily

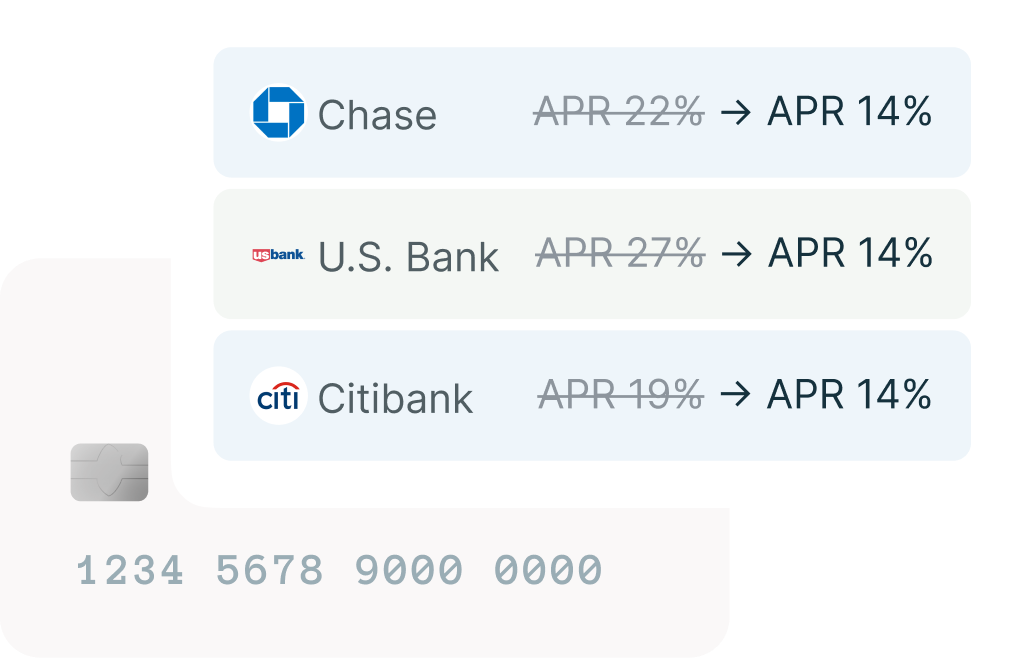

Pay off any credit card balance using your low interest credit line from Gauss, both on-demand and automatically. Your cards get lower APR, and you save money on interest charges and pay off balances faster. Keep using your cards and watch your savings go up. No fees!

Instantly pay card bills with up to $500 of 0% APR money. Never pay a late fee and keep yourself in good standing with banks without spending your cash. Pay Gauss back up to 45 days later. Overdraft protection included for free.

Protect yourself from late fees

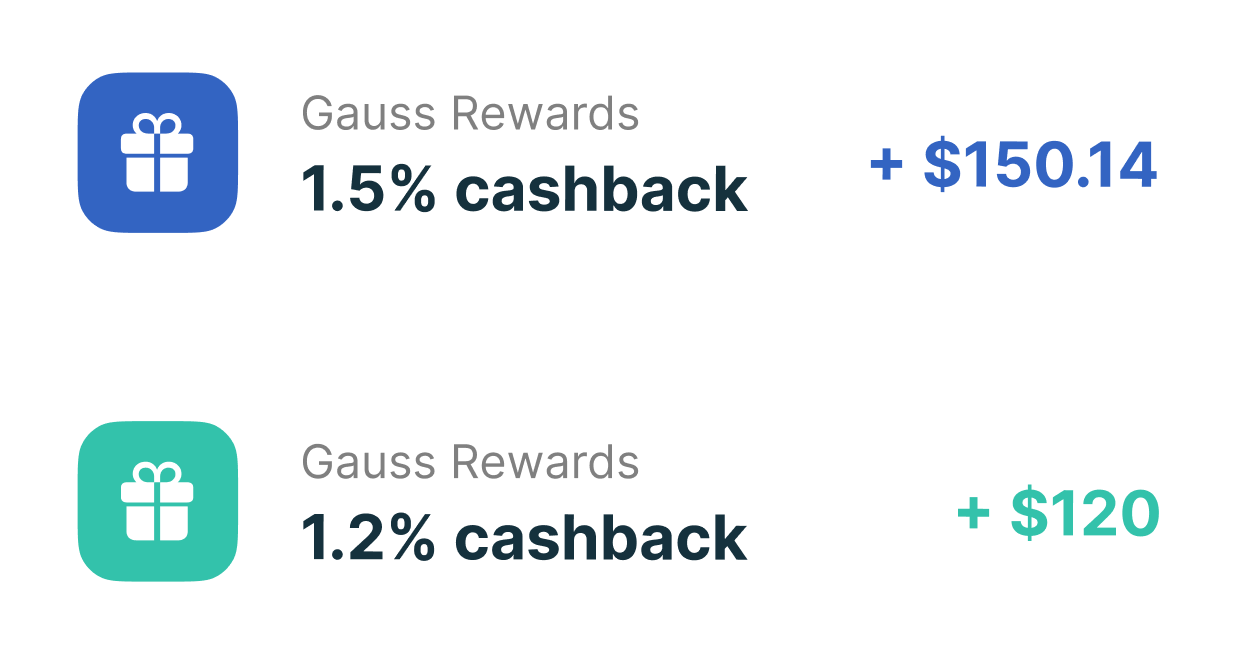

Earn points every time you repay on time. Use them to reduce APRs, increase credit limit, get access to high APY savings and other big prizes! †

Get payoff rewards

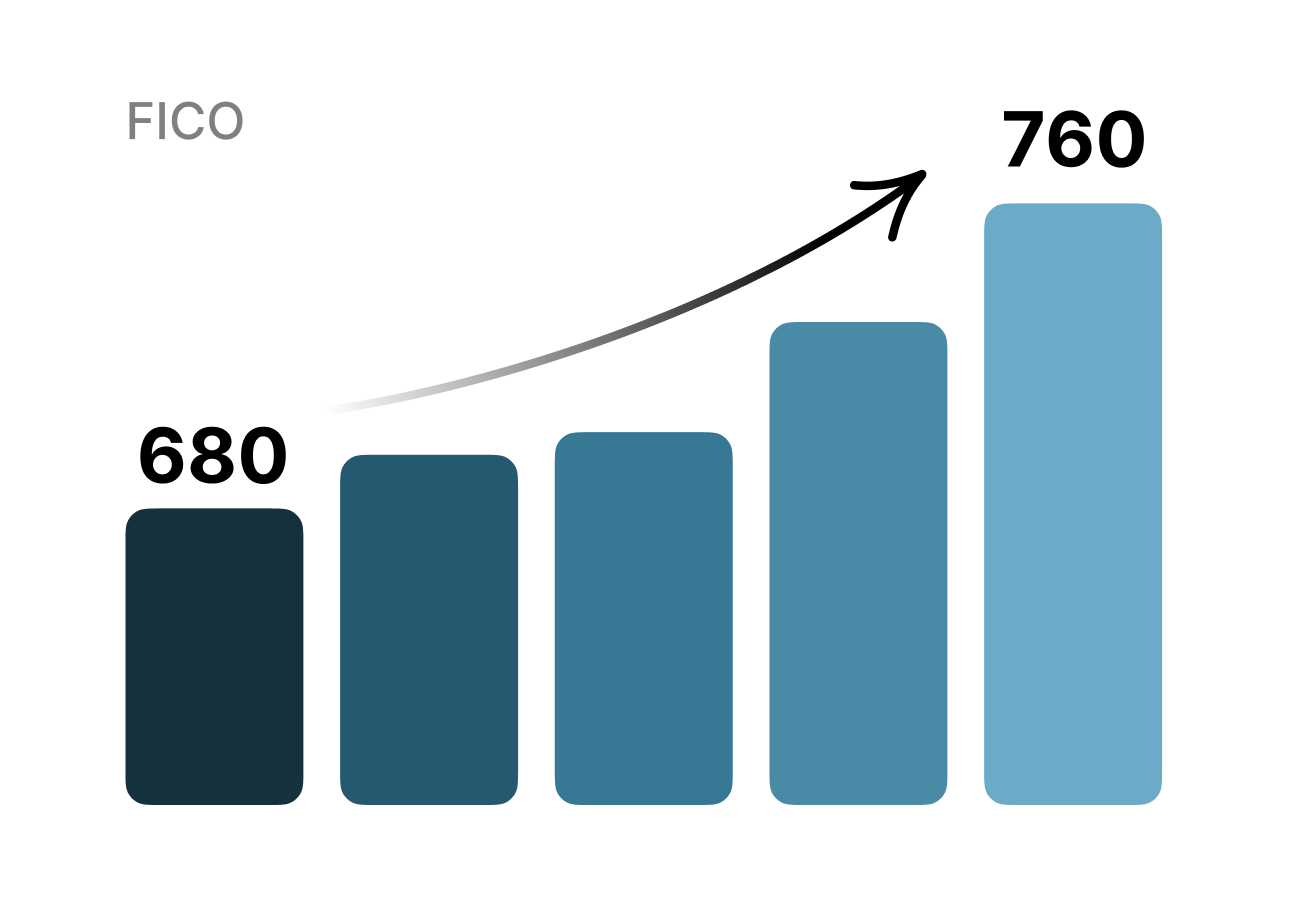

Auto transfer balances from your cards to Gauss low interest credit line. Lower average credit limit utilization and boost credit score! ††

Lower card utilization

Easily learn what it takes to pay off your current balances and see how Gauss can help you pay off faster if you move balances off expensive cards to a low APR Gauss Line. Start with a simple web calculator, then connect your cards to build a personlized plan.

Build a pay off plan

How moving card balances works

Connect credit cards via Plaid

Get Run a soft credit check

Pay off the cards from a low APR Gauss Credit Line

Keep using the cards and repay the line once a month

New balances can be moved to the line automatically.

Earn rewards and better credit terms over time.

Gauss meets the highest security and privacy standards of the banking industry and works with the most reliable data providers, like Plaid and Equifax. Your data safety is our top priority, and we use the strongest encryption and anonymize data whenever possible.

Gauss improves your credit score in most cases.† Gauss prevents late payments and reduces the amount of debt on your cards, reducing their utilization, which has a great positive effect on your credit score. You can improve the score further by paying on time to Gauss.

No fees are charged If you're late with your repayments to Gauss, but your credit score will be negatively affected.

No fees are charged If you're late with your repayments to Gauss, but your credit score will be negatively affected.

If your app is loading normally, please reach out through the built-in support chat. If the app is not loading, ping us over the email support@gauss.club. Support team will get back to you as soon as possible.

If you ever had unpaid credit card balances and/or actively use multiple credit cards, Gauss is for you! Gauss is great at making your credit cards much cheaper and stress-free.

Gauss runs a soft credit check to verify you're in good credit standing. Prime FICO score is required to qualify for the Gauss Credit Line. We also require to connect a primary checking account to automatically verify your income in read-only mode. Confirmed annual income should be more than $40k.

Some features are only available to customers who have at least 3 months of history with us.

Some features are only available to customers who have at least 3 months of history with us.

No, Gauss is a technology company. We provide our customers with tools and capital to make credit cards cheaper and more convenient.

Gauss is built by a team of veterans from global banks like Citi and world-class software engineers. We're on a mission to help people use debt to get better off financially.

Gauss is built by a team of veterans from global banks like Citi and world-class software engineers. We're on a mission to help people use debt to get better off financially.

Gauss products and services are available only to Gauss members. Gauss charges a small membership fee, starting at $4.99/month, that can be canceled anytime.

APR (which is the same as the interest rate) is charged on balances transferred to Gauss credit line from your credit cards. Only high APR balances that cost you interest are transferred, so you always save money with Gauss.*

APR (which is the same as the interest rate) is charged on balances transferred to Gauss credit line from your credit cards. Only high APR balances that cost you interest are transferred, so you always save money with Gauss.*

We're constantly working on expanding Gauss availability. Please download the app to quickly check if Gauss products you're interested in are currently available in your state of residence.

No, Gauss is not a company that takes over your credit card accounts and contacts your creditors. The Gauss credit line can help you pay off your credit card debt in a lump sum and consolidate your monthly credit card bills for you. We can help you manage the payments, protect you against late fees, and lower your APRs to save you money and accelerate debt payoffs.

Join Placid Money

I agree that Placid will inform me by e-mail about financial products and services. My data will be used exclusively for this purpose.

* Gauss credit line APR, which is the same as interest rate, is 12%-16%, depending on a number of factors, including credit profile. The rate is variable with prime rate. The majority of credit cards are eligible for the balance transfer if a credit line is approved.

For example, if user's APR is 24%, total balance is $10,000 and fixed monthly payments are $300, user's interest expense until full payoff would be $6,644 vs. $2,737 with Gauss. Use Gauss payoff calculator to estimate debt-free dates for a different case.

† We top up your rewards account with points every time you pay your Gauss Bill on time. You can use your rewards freely at any time.

†† Credit score stability/improvement is not guaranteed. Credit scores are independently determined by credit bureaus, and on-time payment history is only one of many factors that such bureaus consider. Your credit score may be negatively impacted by other financial decisions you make, or by activities or services you engage in with other financial services organizations.

Gauss Rewards LLC

(626) 424-3424

30 N Gould Street, STE R, Sheridan, WV 82801

Financial services are provided by Placid Inc. DBA Gauss

Copyright 2023. All rights reserved.

For example, if user's APR is 24%, total balance is $10,000 and fixed monthly payments are $300, user's interest expense until full payoff would be $6,644 vs. $2,737 with Gauss. Use Gauss payoff calculator to estimate debt-free dates for a different case.

† We top up your rewards account with points every time you pay your Gauss Bill on time. You can use your rewards freely at any time.

†† Credit score stability/improvement is not guaranteed. Credit scores are independently determined by credit bureaus, and on-time payment history is only one of many factors that such bureaus consider. Your credit score may be negatively impacted by other financial decisions you make, or by activities or services you engage in with other financial services organizations.

Gauss Rewards LLC

(626) 424-3424

30 N Gould Street, STE R, Sheridan, WV 82801

Financial services are provided by Placid Inc. DBA Gauss

Copyright 2023. All rights reserved.

Scan QR Code and Download Placid Money App